Business review

Overview of the Russian power sector

The Russian Federation’s power sector is among the largest in the world; as of 1 January 2025, the total installed capacity of power plants within the United Energy System of Russia (UES of Russia) was 263.7 GW. In 2024, installed capacity increased by 0.62 GW due to the commissioning of 1.7 GW of new capacity, with the decommissioning of old facilities totalling 1.3 GW, and a rise of 0.3 GW due to other factors such as re‑labelling and modernisation.

The UES of Russia covers the most populated areas of the country. Grid interconnections between various energy systems are limited due to vast distances, so the Russian wholesale electricity and capacity market is divided into two pricing zones and four non‑pricing zones.

The first pricing zone, the Europe‑Urals zoneComprises the Central, Middle Volga, Urals, North‑West, and South energy systems., encompasses the European region of Russia and includes integrated energy systems (IES) such as the North‑West, Central, Middle Volga, Urals, and South.

The second pricing zone, the Siberian IES, encompasses Siberia. The electricity prices of the two pricing zones are driven by the differences in capacity and fuel mix in the respective pricing zones. Network constraints play a significant role in the second pricing zone.

Non‑pricing zones include the Kaliningrad Region, Arkhangelsk Region, Komi Republic, and Russian Far East regions. These regions operate under special electricity pricing rules rather than market conditions.

Most of the Group’s energy assets are located in the second pricing zone, within the Siberian IES. The Siberian IES has an operational area of 4.9 million km², with a population of more than 19 million. The Siberian IES comprises 126 power plants with a total installed capacity of 52.5 GW, including 25.4 GW of HPPs (48%), 26.5 GW of CHPs (51%), and 581 MW of solar power plants (1%). The backbone grid of the Siberian IESAccording to the System Operator of the United Energy System of Russia consists of 110‑kV, 220‑kV, and 500‑kV lines, with a total length of over 100,000 km.

A unique feature of the Siberian IES is the significant role of HPPs in both the installed electrical capacity mix and electricity output. Thermal power in the Siberian IES communities is generated mainly through coal‑fired power plants, primarily located near coal‑mining regions.

Electricity generation

In 2024, electricity production in the UES of Russia increased by 4.1% year‑on‑year, reaching a total of 1,180.7 billion kWh compared to 1,134.0 billion kWh in 2023. The generation structure was as follows: CHPs – 57.3%, NPPs – 18.2%, HPPs – 17.3%, WPPs – 0.7%, SPPs – 0.3%, and industrial power stations – 6.1%.

Power generation in the Siberian IES amounted to 233.7 billion kWh (an increase of 3.5% year‑on‑year), with HPPs accounting for 51.7% of total electricity generation, CHPs for 44.2%, and RES for 4.1%. HPP output grew by 5.0% year‑on‑year to 120.8 billion kWh. At the same time, CHPs increased electricity production by 2.7% year‑on‑year to 103.3 billion kWh.

The main factor affecting the overall growth in energy generation in the Siberian IES in 2024 was an increase in demand from data processing centres and aluminium and mining companies.

Electricity demand

Electricity consumption in the UES of Russia rose by 3.1% year‑on‑year to 1,174.1 billion kWh in 2024. The growth was primarily driven by increased consumption from the Central IES (an increase of 8.8 billion kWh), the IES of the South (an increase of 6.5 billion kWh), and the Siberian IES (an increase of 11.2 billion kWh).

The Europe‑Urals pricing zone saw a 2.6% rise in electricity consumption, reaching 884.7 billion kWh. In the Siberian IES, electricity consumption went up by 4.9% to 241.1 billion kWh.

Changes in energy consumption in 2024 were driven by the temperature factor, industrial and household consumption growth.

Electricity and capacity prices

Within the Siberian IES, electricity spot prices are dictated by the marginal costs of the least efficient coal‑fired power plants among those in demand, with HPPs operating as price takers. Over the long term, electricity prices tend to move with thermal coal prices. A significant proportion of the power generated by Siberian CHPs is produced using locally sourced brown coal. Due to seasonality in demand and the fluctuating availability of hydropower, electricity prices can exhibit significant fluctuations throughout the year. One of the primary factors with significant medium‑term influence is the inflow and water reserves in Siberian HPPs’ reservoirs, driving the availability of low‑cost hydropower in the wholesale market.

The capacity market operates somewhat differently from the electricity market, reflecting the long‑term nature of decision‑making. The primary method for selling capacity on the wholesale market is through competitive capacity auctions (CCAs), enabling the selection of the most suitable mix of generating capacities to meet projected demand and establishing a single capacity price within each pricing zone. Currently, CCA capacity prices are set through to 2028 and are then adjusted annually using the Consumer Price Index (CPI) from the previous year minus 0.1%, from 1 January of the CCA year until 1 January of the delivery year.

Capacity prices

| 2024 | 2025 | 2026 | 2027 | 2028 | |

|---|---|---|---|---|---|

| Second pricing zone | 279 | 303 | 299 | 504 | 558 |

In 2024, the CCA‑resulting price for the first pricing zone increased by 14.2% year‑on‑year, including the CPI minus 0.1% adjustment, while the capacity price for the second pricing zone rose by 12.1% year‑on‑year.

A key contributor to higher CCA prices in 2024 vs. 2023 was adjustment for actual 2023 inflation rate of 7.57%.

Electricity prices

In 2024, the average spot price in the day‑ahead market for the second pricing zone reached RUB 1,512 per MWh, a 21.2% increase from 2023. This upward trend was caused by lower HPP generation in the second half of 2024, higher CHP price bid levels, as well as grid limitations on transit between Eastern and Western Siberia, with an increase in the number of hours of flow reversal towards the Irkutsk Region.

The average spot prices in the Irkutsk Region and Krasnoyarsk Territory stood at RUB 1,456 per MWh and RUB 1,474 per MWh, respectively, marking a 25.6% and 22.7% year‑on‑year increase, respectively. This was due to lower generation from the Angara cascade HPPs in the second half of 2024, with an increase in the number of hours of flow reversal towards the Irkutsk Region amid increased consumption, as well as due to higher CHP price bid levels.

As of 31 December 2024, the Group’s total installed electrical capacity stood at 19.5 GWIncluding Onda HPP, with an installed electrical capacity of 80 MW (located in the European part of Russia, leased to RUSAL); excluding Boguchany HPP, with an installed electrical capacity of 2,997 MW (a 50/50 JV between RUSAL and its strategic partner)., while the aggregate installed heat capacity was 13.7 Gcal/h. As of 31 December 2024, HPPs represented 78% of the installed electrical capacity, while the remaining 22% was accounted for by predominantly coal‑fired CHPs and one solar power plant.

In 2024, the Company generated 90.7 billion kWhExcluding Onda HPP, with an installed electrical capacity of 80 MW (located in the European part of Russia, leased to RUSAL), and Boguchany HPP (a 50/50 JV between RUSAL and its strategic partner). of electricity. The share of En+ in the total generation of electricity in the Siberian unified energy system was about 36%, while the Group’s HPPs accounted for approximately 61% of the total hydropower generated in the Siberian unified energy system.

Hydropower generation

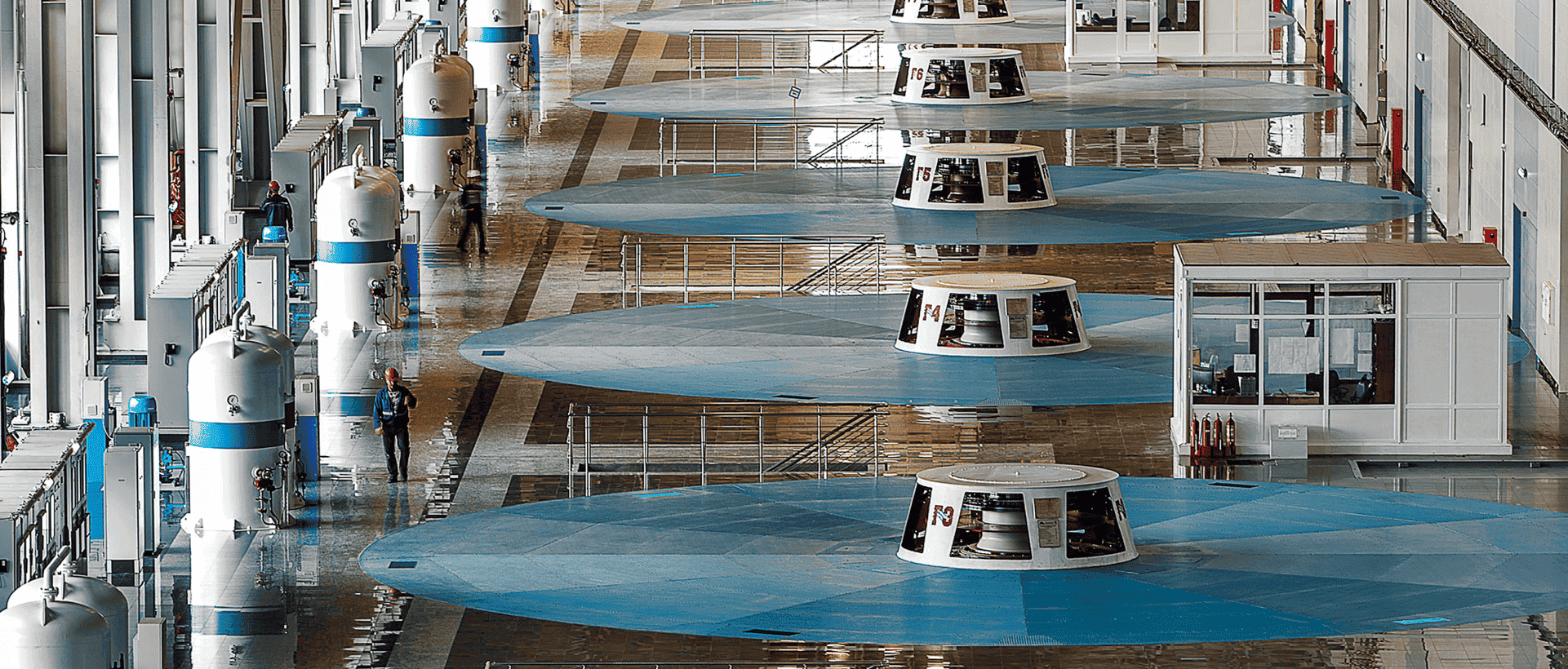

Hydropower generation is the main focus of the Group’s Power segment. The Company operates five HPPsIncluding Onda HPP with an installed capacity of 80 MW (located in the European part of Russia, leased to RUSAL)., including three of the five largest HPPs in Russia and of the twenty largest HPPs globally, in each case in terms of installed electrical capacity. In 2024, the Power segment’s HPPs produced 73.7 billion kWh of electricity, or 81.3% of the Group’s total electricity production.

In 2024, the total output of the Group’s Angara HPP cascade (Irkutsk, Bratsk, and Ust‑Ilimsk HPPs) increased by 4.5% year‑on‑year, to 55.5 billion kWh. This increase can be attributed to the existing water reserves in Lake Baikal and the Bratsk reservoir at the beginning of 2024, high water levels in the reservoirs, and more intensive state‑regulated water discharges compared to 2023 as established by the Yenisei Basin Water Management Board. For example, water levels in Lake Baikal reached 456.51 m (10 cm above the long‑term average) as of 1 July 2024, and 456.63 m (4 cm above the long‑term average) as of 1 December 2024. Water levels in the Bratsk reservoir reached 399.71 m (1.98 m above the long‑term average) as of 1 July 2024, and 399.37 m (0.93 m above the long‑term average) as of 1 December 2024.

Total generation from Krasnoyarsk HPP rose by 15.8% year‑on‑year in 2024, to 18.3 billion kWh. The increase was the result of more intensive state‑regulated water discharges compared to 2023 as established by the Yenisei Basin Water Management Board, driven by increased hydro resources. The maximum level of the Krasnoyarsk reservoir reached 239.26 m in 2024, marking an increase of 3.2 m compared to the 2023 maximum level and remaining 0.4 m below the long‑term average annual maximum.

CHP electricity and heat generation

Electricity generation by the Group’s CHPs rose by 3.0% year‑on‑year to 16.9 billion kWh in 2024. The increase was driven primarily by a 9.2% year‑on‑year surge in electricity consumption within the Irkutsk energy system, along with reduced generation from the Angara HPP cascade in the second half of 2024.

Heat generation totalled 26.3 million Gcal and experienced a 4.0% year‑on‑year decrease due to weather conditions: the average monthly temperature in 2024 was, on average, 1.0°C higher than in 2023.

SPP electricity generation

Abakan SPP generated 5.8 million kWh in 2024, marking a 3.3% year‑on‑year decrease attributed to fewer sunny days during the reporting period.

Coal production

The Coal segment provides the Group’s CHPs with a self‑sufficient coal resource base and covers its internal coal demand. Part of the coal production (16% in 2024) is sold to third parties.

| Location | Installed capacity | 2023 production | 2024 production | ||

|---|---|---|---|---|---|

| Hydropower plants | |||||

| Irkutsk HPP | Russia (Irkutsk Region) | 753.0 MW | 4.6 bn kWh | 4.5 bn kWh | |

| Bratsk HPP | Russia (Irkutsk Region) | 4,500 MW | 25.1 bn kWh | 26.9 bn kWh | |

| Ust‑Ilimsk HPP | Russia (Irkutsk Region) | 3,840 MW | 23.4 bn kWh | 24.1 bn kWh | |

| Krasnoyarsk HPP | Russia (Krasnoyarsk Territory) | 6,000 MW | 15.8 bn kWh | 18.3 bn kWh | |

| Combined heat and power plants | |||||

| CHP‑10 | Electricity | Russia (Irkutsk Region) | 1,110 MW | 4.9 bn kWh | 5.4 bn kWh |

| Heat | 574.0 Gcal/h | 0.3 mn Gcal | 0.5 mn Gcal | ||

| CHP‑9 | Electricity | Russia (Irkutsk Region) | 540.0 MW | 2.5 bn kWh | 2.0 bnkWh |

| Heat | 2,143.0 Gcal/h | 6.0 mn Gcal | 5.7 mn Gcal | ||

| Novo‑Irkutsk CHP | Electricity | Russia (Irkutsk Region) | 726 MW | 3.3 bn kWh | 3.4 bn kWh |

| Heat | 1,959.2 Gcal/h | 5.9 mn Gcal | 5.8 mn Gcal | ||

| Ust‑Ilimsk CHP | Electricity | Russia (Irkutsk Region) | 515 MW | 0.9 bn kWh | 1.2 bn kWh |

| Heat | 1,015.0 Gcal/h | 2.1 mn Gcal | 2.0 mn Gcal | ||

| CHP‑11 | Electricity | Russia (Irkutsk Region) | 320.3 MW | 0.7 bn kWh | 0.9 bn kWh |

| Heat | 1,056.9 Gcal/h | 1.0 mn Gcal | 1.0 mn Gcal | ||

| CHP‑6 | Electricity | Russia (Irkutsk Region) | 287.0 MW | 0.9 bn kWh | 1.0 bn kWh |

| Heat | 1,769.1 Gcal/h | 3.3 mn Gcal | 3.3 mn Gcal | ||

| Novo‑Ziminsk CHP | Electricity | Russia (Irkutsk Region) | 260 MW | 1.3 bn kWh | 1.3 bn kWh |

| Heat | 773.0 Gcal/h | 1.5 mn Gcal | 1.5 mn Gcal | ||

| Avtozavodsk CHP | Electricity | Russia (Nizhny Novgorod Region) | 480 MW | 1.6 bn kWh | 1.7 bn kWh |

| Heat | 2,172.0 Gcal/h | 3.1 mn Gcal | 3.1 mn Gcal | ||

| Solar power plants | |||||

| Abakan SPP | Russia (Republic of Khakassia) | 5.2 MW | 6.0 mn kWh | 5.8 mn kWh | |

| Other assets Other assets include Onda HPP and small‑scale generating and heat‑producing facilities. | |||||

| Electricity | 118.4 MW | 0.6 bn kWh | 0.6 bn kWh | ||

| Heat | 2,228.7 Gcal/h | 4.1 mn Gcal | 3.5 mn Gcal | ||